What if one fine morning, you woke up richer—without spending a single rupee?

You sip your coffee, open your portfolio… and boom—the number of shares has doubled overnight.

No magic. No glitch. Just the power of corporate moves like bonus issues and stock splits.

They don’t increase your total investment value instantly, but they do put a spotlight on the stock. Buzz builds. Volumes jump. And sometimes, prices follow.

These moves often keep a stock in the limelight for weeks—making them prime candidates for your watchlist.

In this article, we will look at 5 such stocks which have announced bonus or stock splits in recent times.

Godfrey Phillips India

Along with its Q1 results, cigarette manufacturer Godfrey Phillips also approved issuance of 2:1 bonus equity shares along with announcing the record date for the final dividend announced in FY25.

This will be Godfrey’s first ever bonus issue.

The company has set Tuesday, September 16 as the record date to determine which shareholders are eligible to receive the bonus shares.

While the record date for getting a final dividend of Rs 60 is set as August 22.

Along with the bonus issue, the company’s board has approved an increase in authorised share capital from ₹25 crore to ₹50 crore.

| Event | Details |

| First Ever Bonus Issue | 2:1 Bonus Equity Shares Approved |

| Bonus Record Date | Tuesday, September 16 |

| Final Dividend | ₹60 per share |

| Dividend Record Date | Friday, August 22 |

| Authorised Share Capital Increase | From ₹25 crore to ₹50 crore |

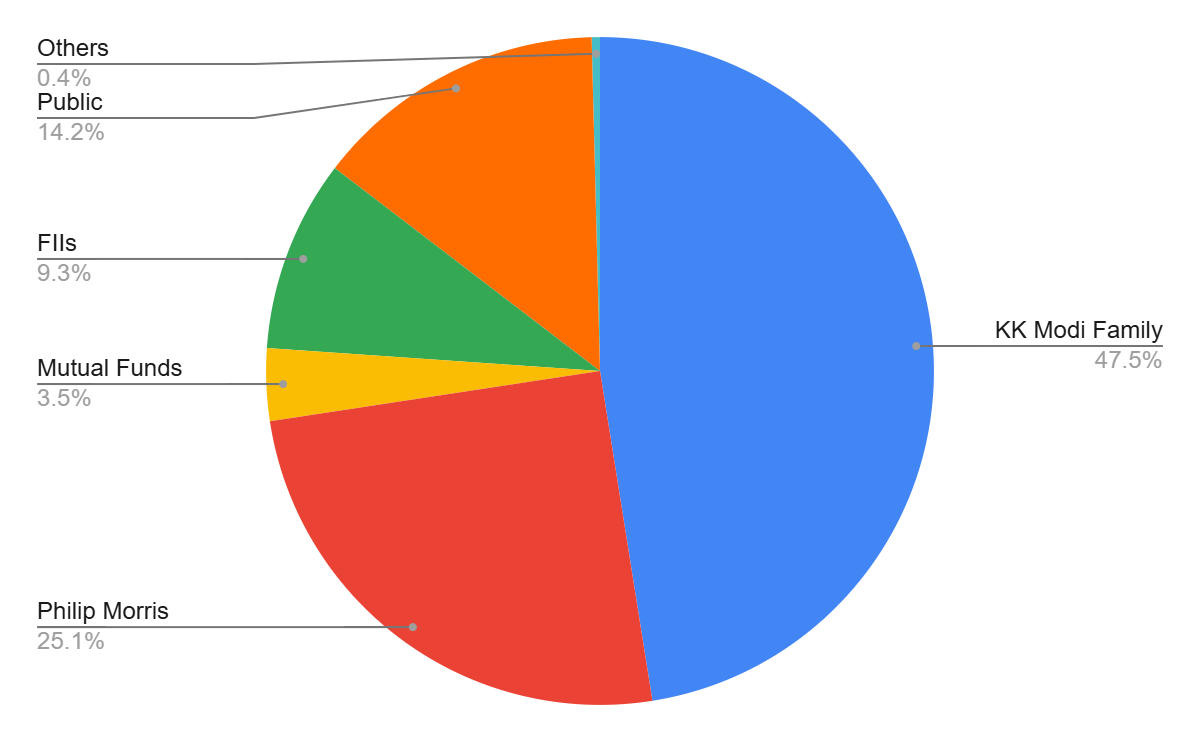

Godfrey Phillips is an associate of the KK Modi Group and Philip Morris Global Brands Inc., where the KK Modi family holds approximately 47% stake and Philip Morris holds around 25%.

Godfrey Phillips India Shareholding Breakup

Source: BSE

The company primarily operates in the cigarette manufacturing business and has been active in India for over 80 years.

Its popular brands include Four Square, Red & White, Stellar, Cavenders, and it also handles the manufacturing and distribution of Marlboro cigarettes in India.

Tata Investment Corporation

Next up is Tata Investment Corp.

That’s right, the Tata group company has joined the list of companies announcing a stock split.

Tata Investment’s board met on 4th August 2025 and approved a stock split in the ratio of 1:10.

This means every existing share with a face value of ₹10 will be split into 10 shares of ₹1 each.

This marks the first stock split under the current shareholding structure.

The record date for the stock split is yet to be finalised. It will be announced after securing shareholder approval and will be communicated in due course.

HDFC Bank

Next up we have HDFC Bank.

Last month, in a landmark move, HDFC Bank’s board announced a 1:1 bonus share issue.

This means that for every fully paid-up equity share held, shareholders will receive one additional share—absolutely free.

What makes this announcement even more special is that this is the first bonus issue in HDFC Bank’s history.

The record date to determine who is eligible for the bonus shares has been set as 27th August 2025.

This bonus issue reflects the bank’s strong performance and robust financials over the years. It also aims to improve liquidity and make the stock more affordable for a broader base of investors.

Karur Vyasa Bank

Next up we have another bank, Karur Vyasa.

On 24th July 2025, Karur Vysya Bank announced a bonus issue in the ratio of 1:5.

This means that shareholders will receive 1 additional equity share (face value ₹2) for every 5 fully paid-up equity shares (₹2 each) they currently hold.

The record date to determine eligible shareholders has been set as 26th August 2025.

This is a significant move for the private lender, as it marks the first bonus issue in nearly seven years.

The announcement reflects the bank’s improved financial health and growing confidence in its long-term growth strategy. It also aims to reward loyal shareholders and improve the stock’s liquidity in the market.

With this, Karur Vysya Bank joins the list of financial institutions using corporate actions to enhance shareholder value in 2025.

India Glycols

Fifth on the list is India Glycols.

The company has announced a stock split in the ratio of 1:2, meaning each equity share with a face value of ₹10 will be split into 2 fully paid-up shares of ₹5 each.

This move is designed to make the stock more affordable and improve liquidity.

Post-split, the authorised share capital will remain unchanged at ₹450 million, but will now be divided into 90 million equity shares of ₹5 each, instead of the earlier ₹10 denomination.

The record date to determine eligible shareholders for the stock split has been set as 12th August 2025.

Conclusion

Bonus issues and stock splits often create excitement in the market — they increase liquidity, improve affordability, and can attract a wider set of investors. But while they may look rewarding on the surface, they aren’t always a signal of long-term wealth creation.

The real question investors need to ask is — does the business merit my capital?

Because unless a company’s profits grow in line with its expanding share base, there’s a risk of earnings dilution, which could limit future upside.

So before jumping in for the sake of a bonus or split, it’s wise to go deeper. Study the company’s financial strength, management quality, and growth roadmap. Treat these corporate actions as part of a broader picture — not the full story.

Happy Investing.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.3 / 5. Vote count: 7

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora