As Indian share markets started the trading session with early gains, a stock stole the limelight with its big debut.

Highway Infrastructure, a developer and manager of infrastructure assets, marked its debut on Dalal Street at the listing price of ₹117 per share, around 67% higher than the issue price of ₹70 per share.

What propelled the listing? Let’s understand.

Highway Infrastructure Company Overview

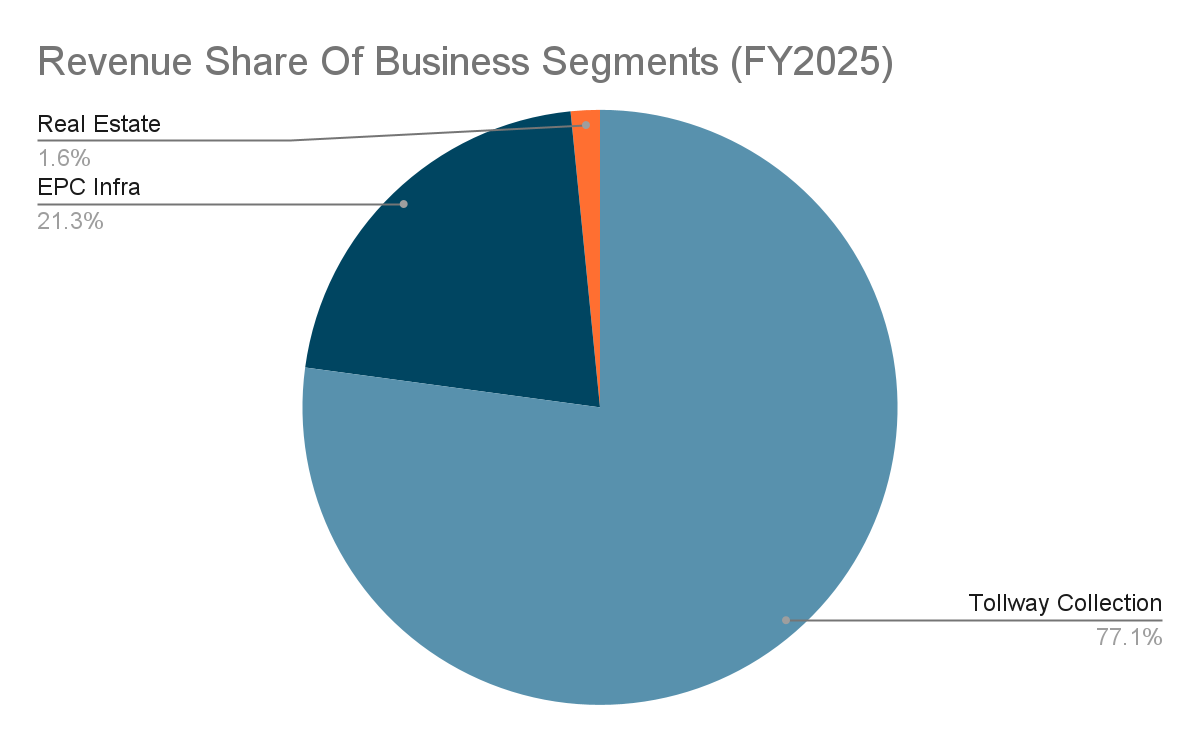

Highway Infrastructure (HIL) is an Indian infrastructure development and management company with a diversified presence across tollway collection, engineering, procurement and construction (EPC) projects, and real estate development.

The tollway collection segment is its primary revenue generator, while the EPC division undertakes projects ranging from roads, bridges, and irrigation structures to civil works for residential, commercial, and hospitality developments.

As of August 31, 2024, HIL had completed 82 projects and had over 27 sites under execution across 11 states and one Union Territory, with a strong operational base in Madhya Pradesh.

Its tollway portfolio includes 24 completed projects and seven active operations, while the EPC segment has delivered 63 completed projects and is currently executing 20 more.

The company’s consolidated order book stood at ₹596.38 crore, comprising ₹314.96 crore from tollway collection contracts and ₹281.42 crore from EPC works.

HIL is among the few toll operators in India to have deployed Automatic Number Plate Recognition (ANPR) technology on the Delhi–Meerut Expressway, alongside RFID-based Electronic Toll Collection systems that enable seamless, contactless toll payments.

The company has combined advanced technology with operational efficiency, and built a strong position in managing high-traffic corridors and executing complex infrastructure projects.

Building on this operational track record and expanding project pipeline, Highway Infrastructure entered the capital markets with its initial public offering (IPO).

Highway Infrastructure Limited IPO and Listing:

Highway Infrastructure’s ₹130 crore IPO was a book-built issue with a price band of ₹65–₹70 per share.

| IPO Offer Summary | Details |

| Issue Size | ₹130 crore |

| Price Band | ₹65–₹70 |

| Fresh Issue | ₹97.52 crore (1.39 crore shares) |

| OFS | ₹32.48 crore (0.46 crore shares) |

| Open Date | August 5, 2025 |

| Close Date | August 7, 2025 |

| Listing Date | August 12, 2025 |

| Lot Size | 211 shares |

| Minimum Retail Investment | ₹14,770 |

The issue saw strong demand, closing with an overall subscription of 316.64 times. Day-wise oversubscription climbed from 27.04x on Day 1 to 72.92x on Day 2, ending above 300x on Day 3.

| Investor Category | Final Subscription (x) |

| QIB | 432.71 |

| NII | 473.1 |

| RII | 164.48 |

| Overall | 316.64 |

On August 12, 2025, the stock opened at ₹117 on the BSE (67.1% premium) and ₹115 on the NSE (64.3% premium). It quickly hit the 5% upper circuit at ₹122.84 on the BSE and ₹120.75 on the NSE, taking total gains from the issue price to over 75%.

Reasons For The Surge In Listing Price

The surge in HIL’s listing price can be attributed to a confluence of demand dynamics, sectoral momentum, and company-specific fundamentals that aligned effectively at the time of its market debut.

- IPO Oversubscription and Market Demand Translation

The IPO experienced significant oversubscription across all investor categories, indicating robust demand well before listing. Many investors who did not receive allotments in the IPO turned to secondary markets to establish positions, creating excess demand that outpaced available supply on the listing day. This imbalance contributed directly to the stock opening at a premium and quickly hitting the upper circuit.

- Sector Momentum and Policy Support

HIL operates in the infrastructure space, a sector witnessing heightened investor interest due to ongoing government-led initiatives and capital expenditure. Programs such as Bharatmala Pariyojana and PM Gati Shakti have improved visibility for future projects, encouraging investor participation in companies with established execution capabilities and order pipelines. The broader sector performance provided a favorable backdrop for HIL’s listing.

- Business Model Differentiation and Growth Visibility

HIL’s integrated model, comprising both annuity-style tolling revenues and EPC execution, positions it uniquely within the infrastructure value chain. The combination of cash-generating assets and project-based growth avenues supported a perception of financial resilience and scalability. This structural differentiation likely influenced positive investor sentiment during the initial trading sessions.

- Reasonable Valuation

HIL was listed at a post-issue P/E of 22.5x, lower than some of its listed peers such as IRB Infrastructure (P/E of 44.38x). This relatively lower valuation made it an appealing option for investors looking to enter the infrastructure sector at a fair price.

- Pre-Listing Indicators:

The grey market premium (GMP) leading up to the listing signaled high investor expectations and speculative interest. While not an official metric, GMP trends often reflect sentiment in the unlisted market and can influence buying behavior on the day of listing.

Apart from the market sentiment and structural strengths, much of the investor confidence also stems from HIL’s underlying financial stability and execution track record reflected in its revenue performance, margins, and order book composition.

Financial Overview of Highway Infrastructure

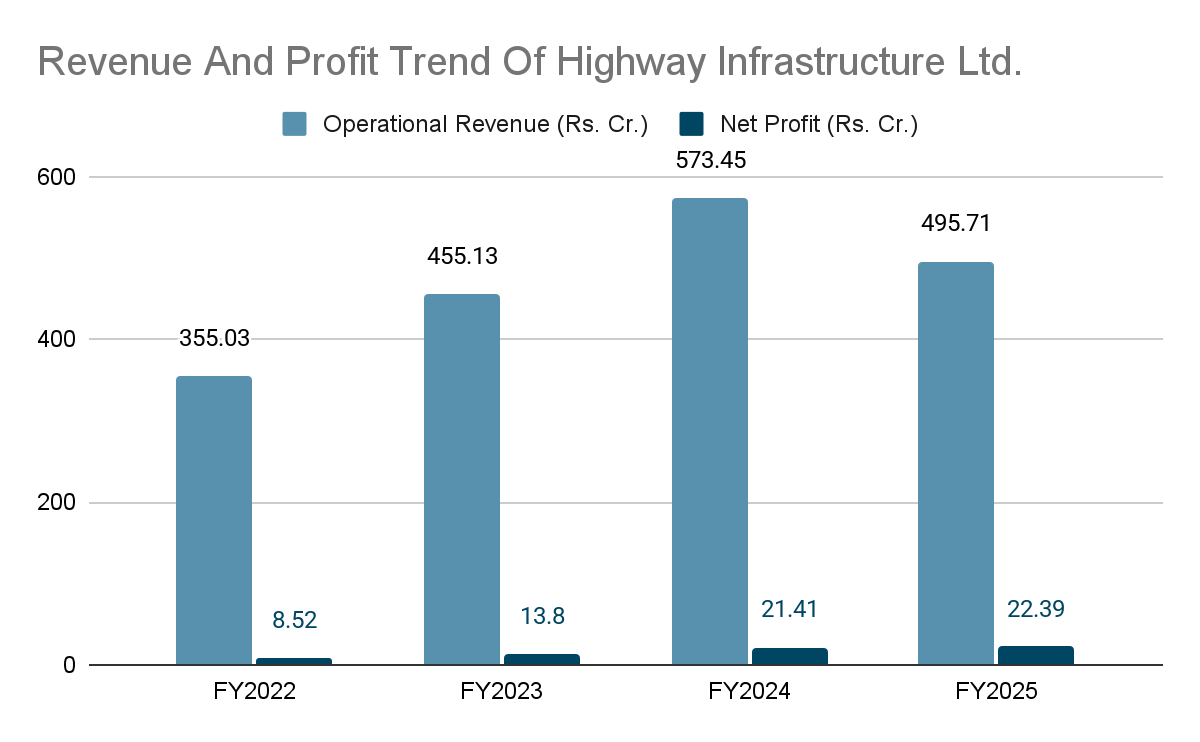

Highway Infrastructure reported revenue from operations of ₹495.7 crore in FY25, reflecting a decline of approximately 13% compared to the previous financial year. Despite the reduction in revenue, the company recorded an increase in net profit, which rose to ₹22.39 crore in FY2025 from ₹21.41 crore in FY2024.

Over the three-year period from FY23 to FY25, net profit increased from ₹13.80 crore to ₹22.40 crore, representing a CAGR of 27.40%.

Conclusion

Highway Infrastructure’s strong market debut, supported by oversubscription momentum, sectoral tailwinds, and an integrated business model, was underpinned by steady profitability, controlled leverage, and a diversified order book. While revenue moderated in FY25, margins and returns remained stable, and debt levels improved.

The IPO performance reflects both market sentiment and the company’s operational track record. Investors may continue to research the company’s execution, sector trends, and upcoming project wins before deciding, and keep a watch on future financial updates for any change in trajectory.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora