In 1988, a small trading business laid the foundation for what would eventually become one of India’s most strategically significant corporations. Founded by Gautam Adani, Adani Enterprises began with a focus on commodity trading, guided by a strong belief in India’s long-term economic potential. Over the decades, the company did far more than expand; it continuously reinvented itself, evolving into a business incubator that has shaped large parts of India’s modern infrastructure landscape.

Today, with a market capitalisation of around ₹2.6 lakh crore and annual revenues nearing ₹1 trillion, Adani Enterprises stands as a reflection of ambition backed by long-term execution. Its journey mirrors India’s own transition from a liberalising economy to a global-scale growth engine.

Early Foundations and Strategic Intent

Originally incorporated as Adani Exports, the company entered the capital markets in 1994. Its IPO was oversubscribed nearly 25 times, an early indication that investors saw promise beyond its modest scale. This came at a pivotal moment for India, as economic liberalisation opened new trade corridors and demand cycles.

Even in its early years, the leadership recognised that trading alone would not define the future. Control over infrastructure, energy, and resources would. This insight became the cornerstone of the company’s long-term strategy and influenced every major decision that followed.

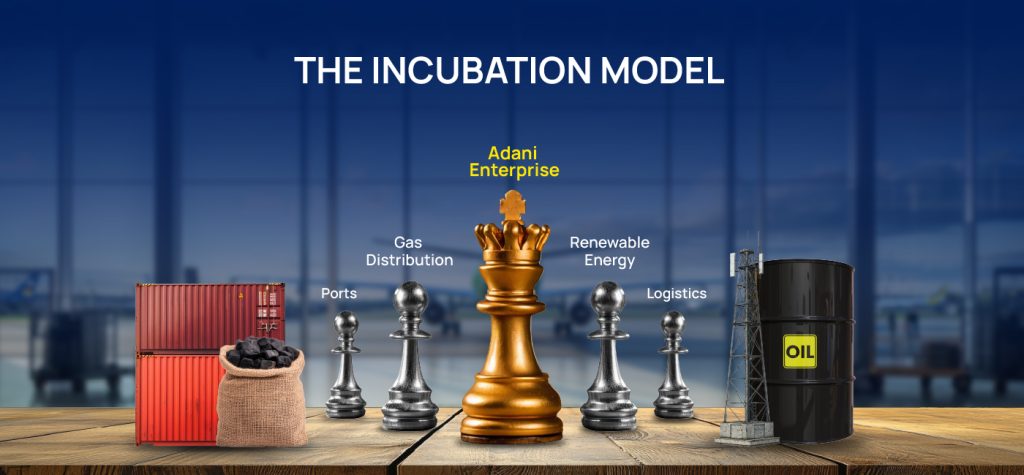

The Incubation Model That Drove Compounding

What truly differentiated Adani Enterprises was its decision to function as an incubator of businesses rather than a single-vertical operator. New ventures were identified early, built patiently, scaled with capital discipline, and eventually spun off as independent listed companies once they reached maturity.

This approach led to the creation of several sector leaders across ports, power, renewable energy, gas distribution, and logistics. For shareholders, the result was sustained wealth creation, with the company delivering a long-term compounded return that significantly outpaced market averages. More importantly, the incubation model ensured that growth was aligned with structural needs of the Indian economy, not short-term market cycles.

Key Milestones That Shaped Market Leadership

The company’s evolution was marked by decisive pivots at critical moments.

In the early 2000s, it entered mining and integrated resource management, strengthening supply-chain control. The following decade saw strategic restructuring, with major businesses demerged and listed independently unlocking value and sharpening operational focus.

A major inflection point arrived in the mid-2010s with the move into renewable energy manufacturing, particularly solar photovoltaics. This positioned Adani Enterprises at the intersection of scale, sustainability, and policy alignment.In the 2020s, the company expanded into airports, defence and aerospace, data centres, and water infrastructure, signalling a clear shift toward nation-critical industries that extend beyond traditional commercial metrics.

Building a Brand Through Purpose and Execution

Adani Enterprises has largely avoided consumer-facing advertising. Instead, its brand has been built through execution and relevance. The narrative consistently centres on nation-building, infrastructure creation, and long-term economic development.

By aligning its businesses with government priorities such as renewable energy adoption, logistics efficiency, and digital infrastructure the company positioned itself as a long-term partner in India’s progress. Credibility was built through delivery, not messaging, resulting in a brand defined by scale rather than slogans.

Navigating Cycles and Volatility

Growth at this scale has not been without challenges. The company has faced regulatory shifts, commodity price volatility, and cyclical downturns across multiple sectors.

Periods of softer coal trading volumes and global uncertainty led to earnings pressure in certain quarters.However, these phases underscored the strength of its diversified model. While legacy segments faced headwinds, newer businesses particularly airports, renewables, and emerging infrastructure delivered growth and stability. By the mid-2020s, consolidated revenues rebounded strongly, reaching close to ₹1 trillion, reinforcing confidence in the company’s ability to adapt and rebalance.

Present-Day Impact and Strategic Positioning

Today, Adani Enterprises operates at the crossroads of infrastructure, sustainability, and technology. Its businesses enable economic activity across sectors that are central to India’s future energy transition, urban mobility, digital infrastructure, and national security-linked industries.The company’s influence extends beyond financial metrics.

Airports redefine travel experience, renewable assets support decarbonisation goals, and data centres underpin the digital economy. Each venture reinforces its identity as a long-term value creator, not a short-cycle operator.

Conclusion: A Legacy Still in Motion

From a modest trading firm to a ₹2.6 lakh crore market leader, Adani Enterprises demonstrates what sustained vision and execution can achieve. Its journey is not merely about expansion in size, but about building relevance in a rapidly changing economic environment.

By incubating future-ready businesses, navigating volatility with resilience, and aligning itself with India’s development priorities, Adani Enterprises has built a legacy rooted in ambition and adaptability. As new sectors emerge and existing ones evolve, the company continues to position itself not just as a participant but as a shaper of India’s economic future.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Jaspreet Singh Arora is the Chief Investment Officer at Equentis, where he heads a seasoned team of equity analysts and turns two decades of market experience into portfolios that consistently beat the benchmark. A go-to voice on cement, building-materials, real-estate, and construction stocks, Jaspreet previously ran research desks at leading brokerages, honing an eye for the metrics that truly move share prices. His plain-spoken analysis helps investors cut through noise and act with conviction. When he’s not deep-diving into earnings calls, you’ll find him unwinding over sports, weekend cricket or a good history podcast.

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora