Jewellery in India is more than an ornament. It’s a market worth billions, shaped by tradition, aspiration, and evolving consumer tastes. And in recent years, one brand has managed to bridge the gap between the timeless allure of gold and diamonds and the convenience of digital-first retail – BlueStone Jewellery & Lifestyle.

From an online startup to a pan-India network of over 275 stores, it has positioned itself as a key player in the modern jewellery landscape.

Now, the company is stepping into the public markets with its ₹1,540.65 crore initial public offering (IPO).

With a strong brand, an omni-channel presence, and ambitious growth plans, BlueStone’s IPO is closely watched by investors and the retail market alike. But the big question is—does this offering have the sparkle to deliver sustainable returns?

Here’s a detailed look at the numbers, the business, and what you need to know before investing.

BlueStone Jewellers IPO Details

| Price Band | ₹492 to ₹517 per share |

| Face Value | ₹1 per share |

| Opening Date | 11 August 2025 |

| Closing Date | 13 August 2025 |

| Total Issue Size (in Shares) | 2,97,99,798 |

| Total Issue Size (in ₹) | ₹1,540.65 Cr |

| Issue Type | Bookbuilding IPO |

| Lot Size | 29 Shares |

| Listing at | BSE, NSE |

Allocation of Shares

For investors looking to participate, the lot size has been set at 29 shares. This means the minimum investment required for a retail investor is between ₹14,268 (at the lower price band) and ₹14,993 (at the upper band). For Small High Net-worth Individuals (sNII), the minimum application size is 14 lots, or 406 shares, amounting to ₹2,09,902. For Big High Net-worth Individuals (bNII), the minimum application is 67 lots, or 1,943 shares, which requires an investment of ₹10,04,531.

| Investor Category | Lots | Shares | Investment Amount |

| Retail (Min) | 1 | 29 | ₹14,993 |

| Retail (Max) | 13 | 377 | ₹1,94,909 |

| S-HNI (Min) | 14 | 406 | ₹2,09,902 |

| S-HNI (Max) | 66 | 1,914 | ₹9,89,538 |

| B-HNI (Min) | 67 | 1,943 | ₹10,04,531 |

Objectives

The company plans to use ₹750 crore from the fresh issue proceeds to fund its working capital requirements, with the remaining amount allocated towards general corporate purposes. This infusion is aimed at strengthening its balance sheet, supporting operational expansion, and meeting day-to-day funding needs in a capital-intensive sector like jewellery retail.

BlueStone IPO Grey Market Premium (GMP)

As of August 11, 2025, the grey market premium (GMP) for this IPO stood at ₹9 per share, indicating a potential listing price of ₹526 — about 1.74% higher than the upper end of the price band. While GMP figures can offer a glimpse into market sentiment, they are unofficial and subject to change until the listing date.

Company Overview

BlueStone Jewellery & Lifestyle is a digital-first, direct-to-consumer (DTC) jewellery company that was established in 2011. Originally launched as an online platform, it has since evolved into one of India’s leading omnichannel jewellery retailers, blending a strong digital presence with tactile, in-store experiences. As of March 31, 2025, BlueStone has grown to 275 operational stores spanning 117 cities across 26 States and Union Territories, delivering to more than 12,600 PIN codes.

The company’s retail network includes 200 company-owned outlets and 75 franchise stores, together covering over 605,000 square feet of showroom area. A differentiating strength lies in its in-house design and manufacturing capabilities. The company boasts manufacturing facilities in Mumbai, Jaipur, and Surat, with over 75% of its production done internally. This vertical integration allows faster product turnaround and tighter quality control.

BlueStone’s technology and retail strategy are central to its identity. Its digital platforms, website and mobile app feature over 7,400 designs, 360° product views, AI-based recommendations, and services like ‘Try at Home’. These capabilities are tightly integrated with its physical stores, enabling streamlined omni-channel experiences.

Financials

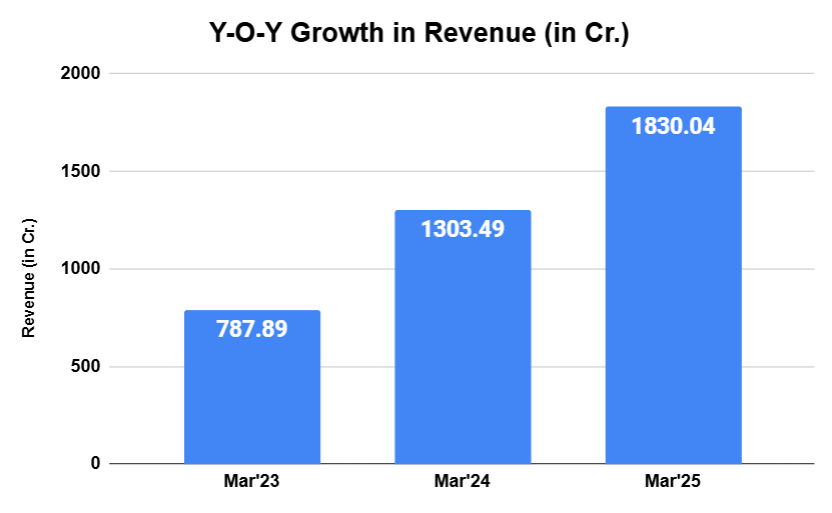

Between FY24 and FY25, BlueStone Jewellery & Lifestyle reported a strong 40% growth in revenue, with total income rising from ₹1,303.49 crore to ₹1,830.04 crore.

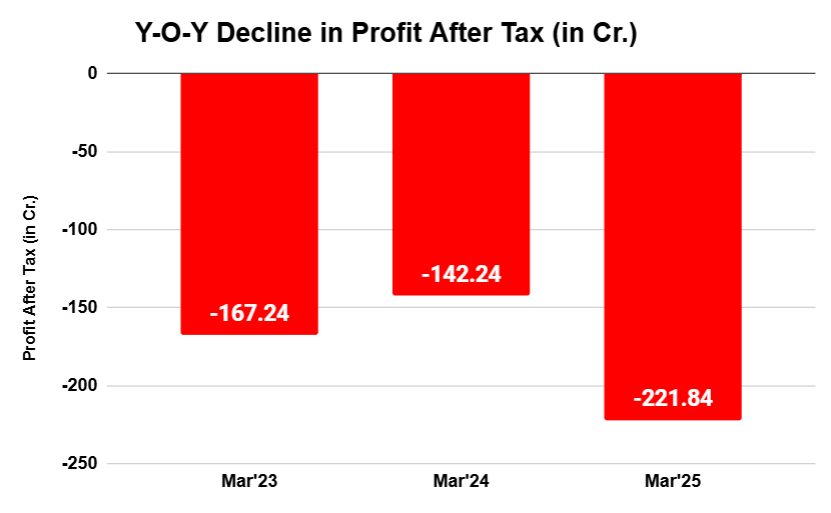

However, despite this top-line expansion, the company’s net loss widened.

On the balance sheet front, borrowings also climbed sharply, increasing from ₹430.43 crore in FY24 to ₹728.62 crore in FY25, indicating higher debt levels to support business expansion.

SWOT Analysis

| STRENGTHS | WEAKNESSES |

| Established digital-first jewellery brand with strong omni-channel presence Fully integrated operations from design to delivery Broad geographic reach across tier-I, II, and III cities Founder-led with professional management and marquee investors | Persistent losses despite revenue growth Rising debt levels to fund expansion Dependent on volatile precious metal prices |

| OPPORTUNITIES | THREATS |

| Expanding organised jewellery market in India Scope to grow in smaller cities and towns Increasing consumer shift toward branded jewellery | High competition from traditional jewellers and large retail chains Fluctuations in gold and diamond prices impacting margins Macroeconomic factors affecting discretionary spending |

Conclusion

BlueStone Jewellery’s IPO combines the appeal of a strong brand, wide retail footprint, and differentiated product strategy with the challenges of recent losses and rising debt.

The company’s steady revenue growth and aggressive store expansion underline its ambition to dominate India’s organised jewellery market, while its omnichannel model positions it well to capture evolving consumer trends.

However, profitability pressures and competitive intensity remain key factors for investors to weigh.

For those considering an entry, a careful look at the company’s financials, market positioning, and growth plans will be essential before committing.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora