Despite falling revenues, HCC share price has seen a massive jump of over 500% in the last five years. The company is a premier engineering and construction firm specializing in infrastructure projects, including dams, bridges, tunnels, hydroelectric, and nuclear energy facilities.

It was involved in some major critical national infrastructure projects like Bandra Worli Sea Link, Kundankulam Nuclear Power Plant, Delhi Metro, and constructing multiple tunnels on the Udhampur-Srinagar-Baramulla rail line, including a 10.2 km tunnel on the Dharam-Qazigund section.

So, what’s happening with the HCC share price, and why is the revenue declining? We will examine this in more detail.

Brief Overview of HCC

Hindustan Construction Company (HCC) was established in 1926 by industrialist Walchand Hirachand. Headquartered in Mumbai, HCC operates in engineering and construction, real estate, and infrastructure development. The company specializes in large-scale infra developments like transportation, power, water, and urban development.

HCC is known for its technical excellence, particularly in tunnelling, dam construction, and heavy civil engineering. It is one of the few Indian firms with the capability to undertake complex nuclear and hydro power civil works.

HCC Leadership Team

Mr. Arjun Dhawan is the Executive Vice Chairman. He serves on the Boards of the company and oversees operations spanning Engineering & Construction and Infrastructure Concessions.

Mr. Jasprit Singh Bhullar is the Managing Director and Chief Executive Officer at HCC. A seasoned construction business management professional, Mr. Jasprit has over 30 years of experience in the construction industry. Before joining HCC, he was with Multiplex Construction, a Brookfield Company, where he was working as Managing Director.

Mr. Rahul Shukla is the Chief Financial Officer and has been with HCC since 2010. He holds a degree in Mechanical Engineering and an MBA in Finance and Operations from MDI Gurgaon. At HCC, Mr. Shukla played a key role in fundraising initiatives, monetizing non-core assets, and completing the debt resolution plan. His career spans over 23 years, and he has worked in organizations like NTPC and L&T Power.

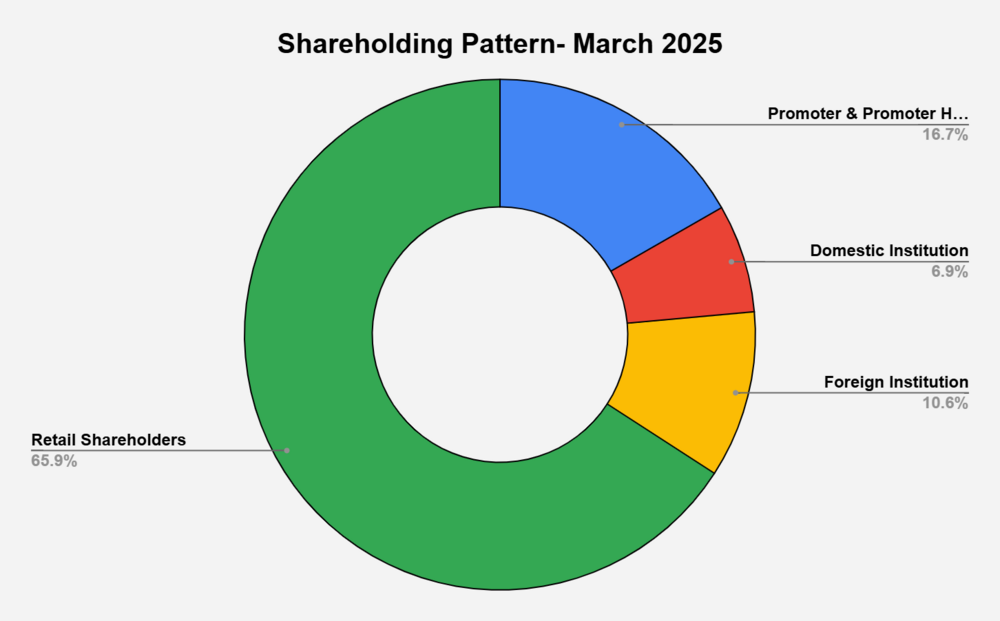

HCC Shareholding Pattern

HCC promoters have pledged 78.8% of their holdings, and a large part of the company is held by retail shareholders.

HCC Financials

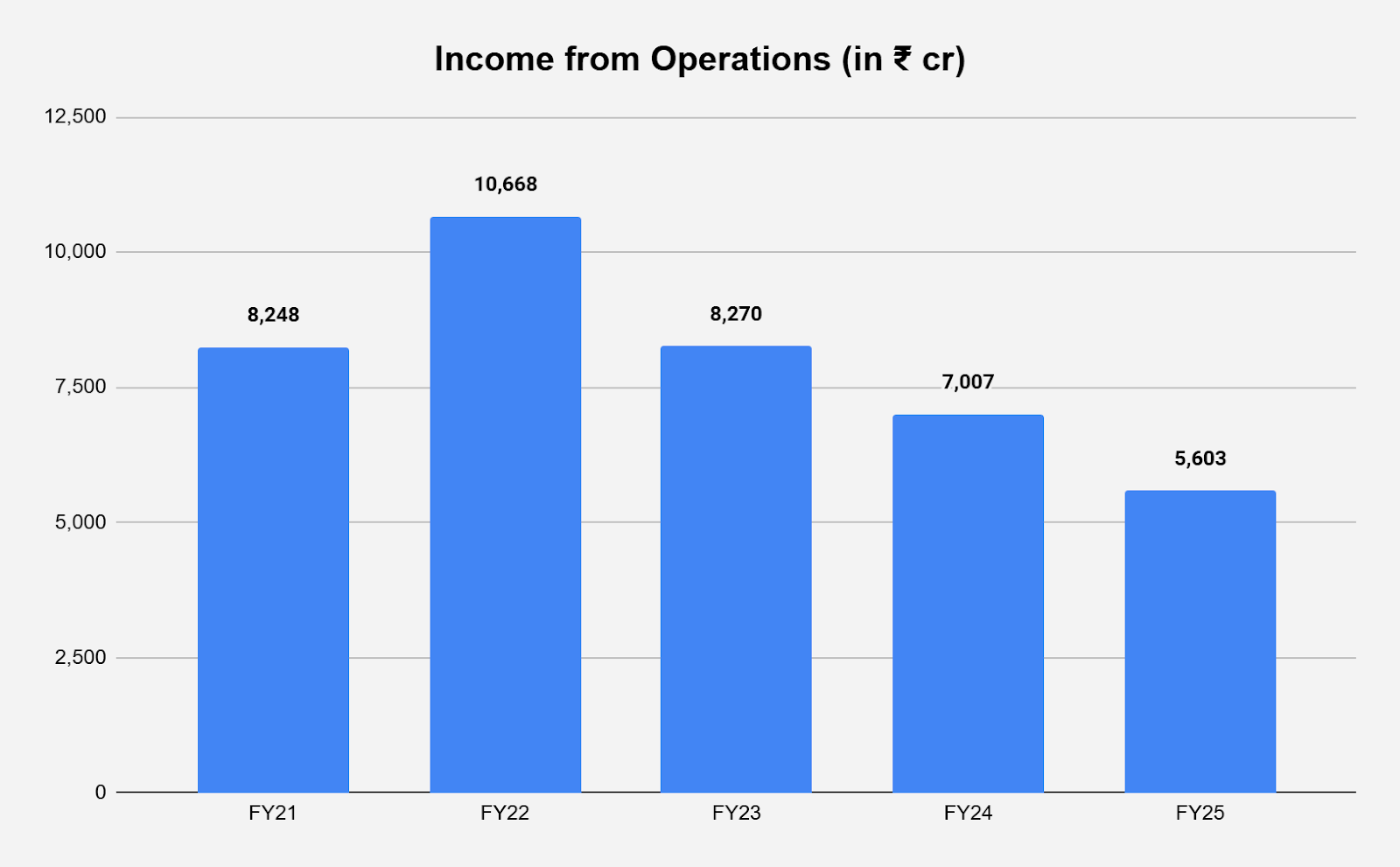

In FY25, HCC’s income from operations declined 20% to ₹5,603 crores from ₹7,007 crores in FY24. The revenue has been on a declining trend since FY22.

The decline in revenue is due to multiple factors, including project slowdowns and execution delays, and the divestment of international subsidiaries.

EBITDA

In FY25, HCC’s EBITDA saw an increase of 18.3% to ₹794 crores. EBITDA margin increased from 14.2% to 19.4%.

| FY21 | FY22 | FY23 | FY24 | FY25 | |

| EBITDA Margin (%) | 11.6 | 16.9 | 13.6 | 14.17 | 19.43 |

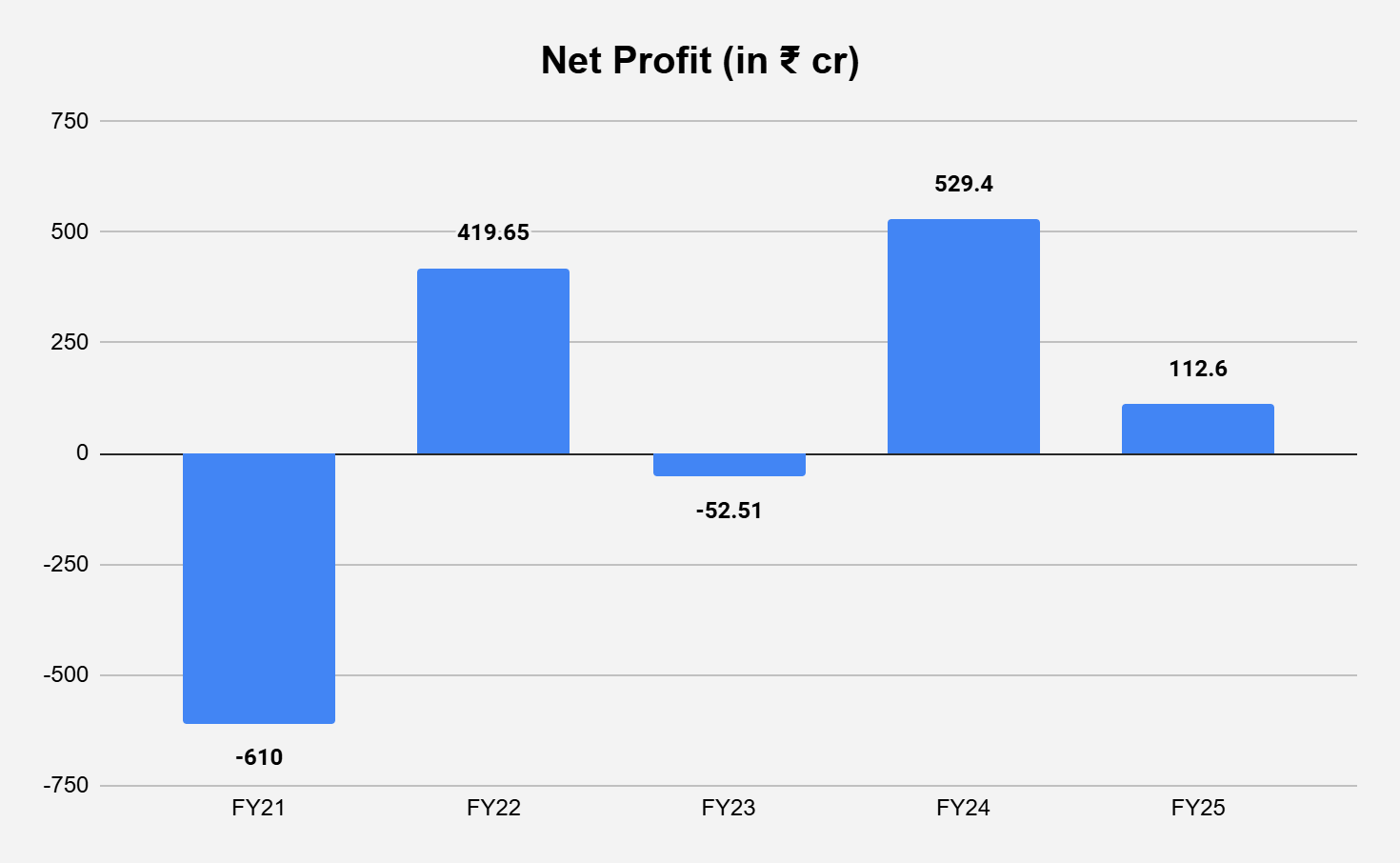

Net Profit

The net profitability of the company has been inconsistent over the years. In FY25, HCC’s net profit declined 78.7% to ₹112.6 crores from ₹529.4 crores.

Earnings Per Share (EPS)

The EPS growth of HCC has been inconsistent over the years, swinging from negative EPS to positive EPS growth.

| FY21 | FY22 | FY23 | FY24 | FY25 | |

| EPS (₹) | -3.63 | 3.35 | -0.17 | 2.85 | 0.62 |

Key Financial Metrics

Return on Equity: HCC’s ROE declined from 35.91% in FY23 to 19.71% in FY24.

Return on Capital Employed (ROCE): In FY24, the ROCE of the company improved to 22.4%, from 19.4% in FY23.

HCC Share Price Analysis

As of 9th July 2025, the market cap of HCC is ₹5,336 crores.

HCC share price has delivered an annualized return of 43% over the last five years. It rose from ₹6.45 per share in June 2020 to currently trading around the ₹30 level (19th June 2025). The 52-week high level of HCC share price is ₹57.50.

The company has no history of paying dividends to its shareholders.

HCC Share Price Future Growth Potential

Following are a few key positives and negatives that could impact HCC share price:

Positives

Strong order book growth: The company has a current order backlog of ₹11,852 crores and has planned ₹54,000 crores worth of bids for FY26.

Debt Restructuring and Financial Restructuring: In Q4FY25, the company repaid ₹534 crores of debt, with ₹134 crores of additional prepayment. Aim to reduce total debt to ₹2,500 crores by FY26 end.

Successful Fundraising: The company completed a ₹350 crore rights issue and ₹600 crore QIP, enhancing working capital and growth execution.

Negatives

Revenue Decline: HCC’s FY25 consolidated revenue declined 20% year-on-year, primarily due to the divestment of the Swiss subsidiary and lower execution volume.

Muted Order Inflows in FY25: Only ₹3,800 crore converted into actual orders during FY25, lagging peers. Plus, the company has guided flat revenue growth in FY26, with growth expected only from FY27- 28 onwards.

High Interest and Tax Costs: Despite margin expansion, high finance costs of nearly ₹600 crore and tax expense of ₹410 crore lowered net profit.

While financial discipline, debt reduction, and operational execution are major positives, flat near-term growth, sluggish order inflows, and legacy asset overhang could weigh on the stock. Share price movement will likely depend on order conversion in FY26 and execution pace.

FAQ

Why is HCC share price so volatile?

HCC share price tends to be volatile due to its high debt levels, slow project conversion, and inconsistent profit growth. News on new orders, debt repayments, or claim recoveries often triggers sharp stock reactions.

How has HCC share price performed in the last five years?

HCC share price has given an annualized return of 43% over the last five years, as of 9th July 2025. HCC share price was trading below ₹10 five years ago, and has touched a high of ₹57.5 in July 2024.

What is the future outlook for HCC?

HCC plans to scale its order book to ₹20,000 crore and has a ₹54,000 crore bid pipeline for FY26. Growth is expected to pick up from FY27, backed by the government infrastructure push and project execution.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 6

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora