HDFC Bank isn’t just another name in Indian banking — it’s a giant.

As India’s largest private sector bank by assets, and the 10th largest bank in the world by market cap, its scale speaks for itself.

The game changed even more after its merger with HDFC. The combined powerhouse is now the 7th most valuable bank globally.

Headquartered in Mumbai since 1994, HDFC Bank has earned deep trust and loyalty over the years — thanks to its strong brand, customer-first approach, and relentless focus on innovation.

From retail banking to corporate solutions, and from net banking to mobile banking — HDFC Bank offers a full suite of financial services that cater to individuals and businesses alike.

Today, the company surprised investors by announcing that its board will consider a bonus shares issue and special dividend in its board meeting on Saturday, 19 July 2025.

Investors reacted positively and the stock price climbed 1% in early trade. In fact, the stock is trading at its 52-week high.

HDFC Bank – 1 Year Share Price

Let’s understand the implications of the upcoming bonus shares, and how it could impact your investments.

Upcoming Board Meeting

HDFC Bank always declares its results on an off-trading day, usually Saturday.

India’s largest private sector lender today announced that its board will consider issuing bonus shares and a special interim dividend for FY26 during the upcoming meeting on July 19.

The board meeting, originally scheduled to consider and approve the unaudited standalone and consolidated financial results for the quarter ended June 30, 2025, will now also deliberate on bonus shares and special dividend proposal.

The last time HDFC Bank declared a special dividend was in August 2019 when the board had approved Rs 5 per share as dividend. HDFC is a true dividend paymaster, and barring the pandemic year, has never missed paying a dividend each year.

HDFC Bank’s Rich Dividend History

| Year | Dividend Per Share (Rs) |

| FY25 | 22.0 |

| FY24 | 19.5 |

| FY23 | 19.0 |

| FY22 | 15.5 |

| FY21 | 6.5 |

| FY19 | 20.0 |

| FY18 | 13.0 |

| FY17 | 11.0 |

| FY16 | 9.5 |

| FY15 | 8.0 |

| FY14 | 6.9 |

Source: BSE

Moreover, if this bonus proposal is approved, this will be the first instance where HDFC Bank will give away bonus shares.

In its 38-year history, HDFC Bank has never declared a bonus share—only stock splits in 2011, and 2019.

Unlike stock splits (e.g., the 5:1 split in 2011 or 1:1 in 2019), bonus shares directly increase liquidity and democratize ownership.

With over 3.6 million retail shareholders holding 10.3% equity, a bonus issue could make the stock more affordable, attracting small investors and boosting retail participation.

Overall, this dual move of special dividend and bonus, announced ahead of its July 19 board meeting, signals a bold strategy to enhance shareholder value and strengthen its market position.

HDFC Bank Q1 Update

Along with the bonus proposal, the key focus would be on HDFC Bank’s results.

Earlier this month, the bank shared its update for Q1 wherein its average gross advances saw a growth of around 6.7% during the quarter.

Meanwhile, HDFC Bank’s deposits increased by 16.2% YoY.

The bank’s CASA deposits jumped 8.5% in the June 2025 quarter. CASA deposits are a crucial source of funding for banks, as they are relatively low-cost compared to other deposit types like fixed deposits.

HDFC Bank Q1FY26 Business Updates

| Particulars | Q1FY25 | Q4FY25 | Q1FY26 | QoQ % | YoY% |

| Gross Advances | 24,86,900 | 26,43,500 | 26,53,000 | 0.36% | 6.68% |

| CASA (In Crores) | 8,63,600 | 9,44,600 | 9,37,000 | -0.80% | 8.50% |

| Time deposits (In Crores) | 15,15,400 | 17,70,200 | 18,27,000 | 3.21% | 20.56% |

| Total Deposits (In Crores) | 23,79,000 | 27,14,300 | 27,64,000 | 1.81% | 16.18% |

| CASA Ratio % | 36% | 35% | 34% | -2.57% | -6.61% |

Source: Company Filings

Based on the steady growth in advances and deposits, investors are expecting HDFC Bank to report a decent rise in both net interest income and overall profit for the quarter.

As of FY25, the bank’s loan book was Rs 26.4 lakh crore.

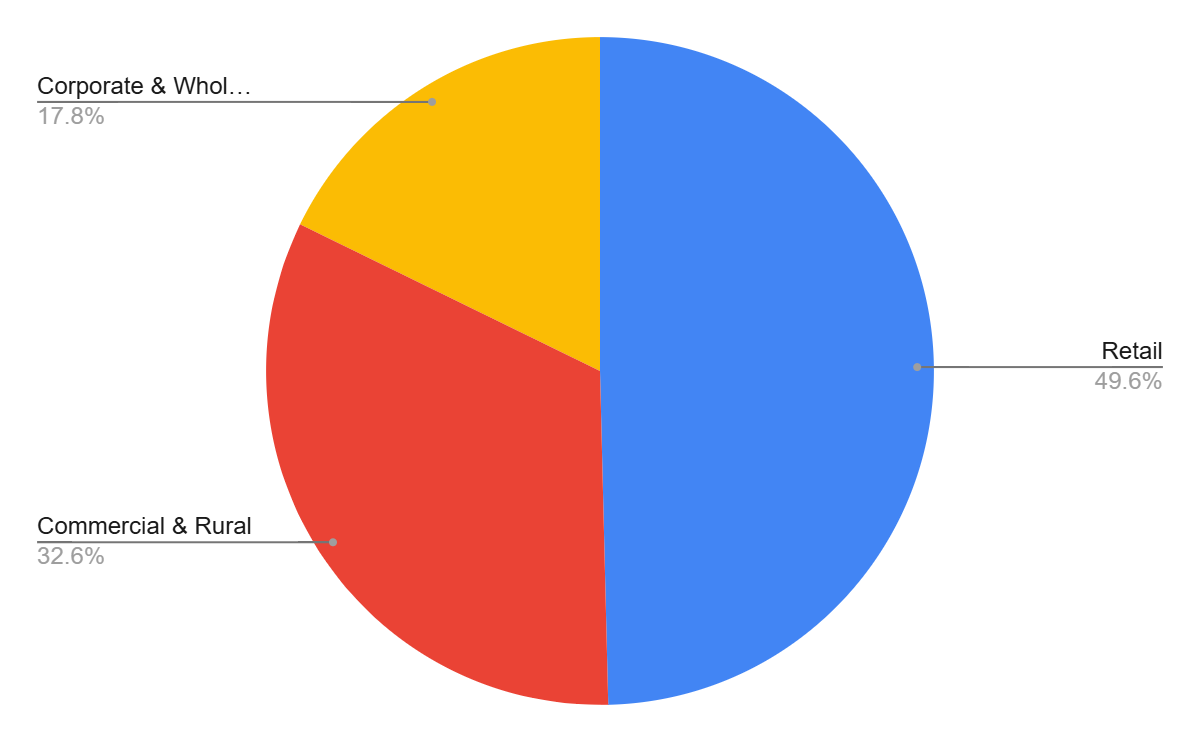

Loan Book Breakup (FY25 Loan Book Rs 26.4 Lakh Crore)

Source: Company Reports

Conclusion

Going ahead, HDFC Bank expects to grow at market rate and the focus remains on gaining market share in deposits to enable loan growth.

Overall, HDFC Bank remains in a sweet spot due to its domestic focus, strong asset quality, and a broad customer base across retail and corporate segments.

Overall, the bank’s move to announce special dividend and bonus shares signals a bold strategy to enhance shareholder value and strengthen its market position.

Happy Investing.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 3.3 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora