India’s banking sector is more than just a facilitator of financial transactions. It’s a key pillar of the country’s economic growth story.

From enabling credit access for individuals and businesses to mobilising capital and promoting financial inclusion, banks play a critical role in shaping the country’s economic direction.

And among the top private players, Kotak Mahindra Bank has long held a reputation for prudent lending, strong management, and consistent performance.

But even the most trusted names aren’t immune to market realities.

Kotak’s latest Q1 results failed to excite investors. Margins showed stress, provisions spiked, and the overall commentary hinted at underlying challenges — particularly in unsecured retail and microfinance.

The result?

The stock took a hit. Analysts are now re-evaluating the bank’s near-term outlook. And questions are being raised — is this just a speed bump in Kotak’s journey, or are we entering a phase where the bank will have to fight harder to keep up with peers like HDFC Bank and ICICI?

Let’s break down the numbers, the commentary, and what it could mean for investors.

Kotak Mahindra Bank Q1 Results

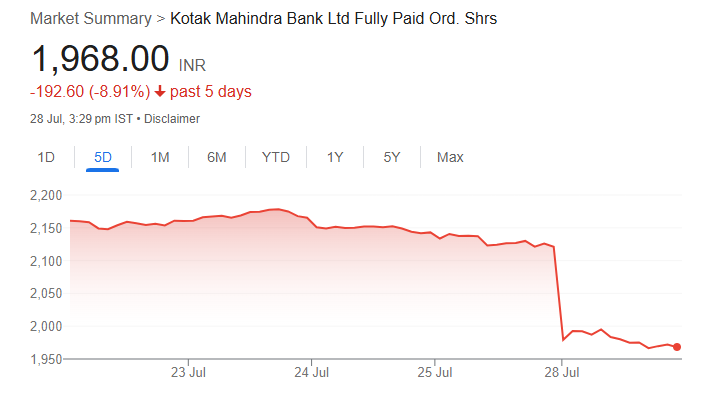

In early trade today, Kotak Mahindra Bank share price fell 5% after investors digested the bank’s earnings that it reported over the weekend.

Kotak Bank Shares Slip Post Q1 Results

Net Profit Drops Due to Margin Pressure and Higher Provisions

Kotak Mahindra Bank’s standalone profit after tax (PAT) declined 8% quarter-on-quarter. There were two key reasons behind this:

- Margin Pressure: The bank’s Net Interest Margin (NIM) fell by 32 basis points to 4.65%, primarily due to the impact of the recent rate cut and a rising share of low-yielding corporate loans.

- Rise in Provisions: Asset quality deterioration forced the bank to set aside more funds for bad loans, which further dragged down profitability.

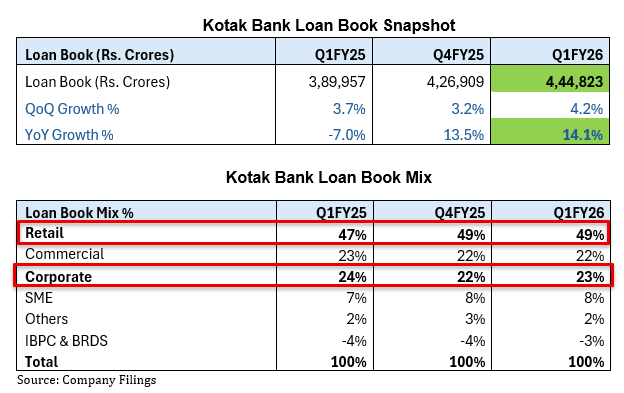

Asset Growth

The bank’s loan book grew 14% year-on-year, reaching ₹4.4 trillion. However, this growth was largely driven by corporate and home loans — segments that typically carry lower yields and hence offer thinner margins.

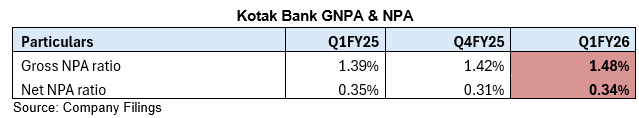

Asset Quality Deteriorates

Slippages rose to 1.9%, mainly due to stress in microfinance (MFI), retail commercial vehicles (CV), and rural segments.

The Gross NPA (Non-Performing Assets) ratio also increased to 1.5%.

Management View and Outlook

According to Kotak Bank’s management, stress in the MFI segment is believed to have peaked and is expected to gradually improve.

Inactive credit card accounts have been weeded out, delinquencies remain stable, and credit costs could come down in the second half of the year.

In the personal loan segment, credit cost is now under control.

Retail CV stress may persist a bit longer, but the bank has implemented risk-mitigation measures.

While the SME segment is being closely monitored, no major red flags have emerged yet.

Kotak Bank’s management has also indicated that margin pressure may continue into Q2, as the full impact of repo rate cuts plays out. However, margins are expected to gradually stabilise and improve, aided by internal cost efficiencies and benefits from lower CASA rates.

While loan and deposit growth is likely to sustain, the market will keep a close eye on trends in asset quality and NIMs going forward.

What Next for Kotak Bank?

Kotak Mahindra Bank is one of the frontrunners in India’s financial services space, with a presence that goes beyond traditional banking — covering insurance, wealth management, and capital markets.

Looking ahead, the landscape could shift meaningfully if Kotak chooses to demerge some of its non-banking businesses. The core banking arm, with its strong digital presence and expanding market share, could thrive as a standalone entity.

At the same time, businesses like Kotak Life Insurance and Kotak Securities could scale independently. For shareholders, this could be a significant value unlock.

Conclusion

Kotak Mahindra Bank is doubling down on technology investments, not just to meet regulatory expectations from the capital market watchdog, but also to stay ahead in an increasingly competitive banking landscape.

As part of its long-term strategy, the bank has set an ambitious goal: to be among India’s top three private sector banks by 2030.

To get there, Kotak is pursuing a mix of organic and inorganic growth, with a sharp focus on tech-led innovation and profitability.

Once digital restrictions imposed by the capital markets regulator are lifted, Kotak is prepared to swiftly onboard new customers and grow its credit card base, capitalising on its tech infrastructure and distribution strength.

That said, execution remains key — and with rising competition and regulatory scrutiny, Kotak will need to deliver consistently on growth, margins, and digital transformation to stay on course.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora