Tata Motors is reportedly close to acquiring Italian truck manufacturer Iveco for $4.5 billion. If finalised, this deal would become the Tata Group’s second-largest acquisition after its iconic Corus buyout in 2007.

It would also be Tata Motors’ biggest purchase since acquiring Jaguar Land Rover for $2.3 billion in 2008. The deal involves buying out the Agnelli family’s investment firm Exor’s stake in Iveco and making a tender offer to purchase the remaining shares.

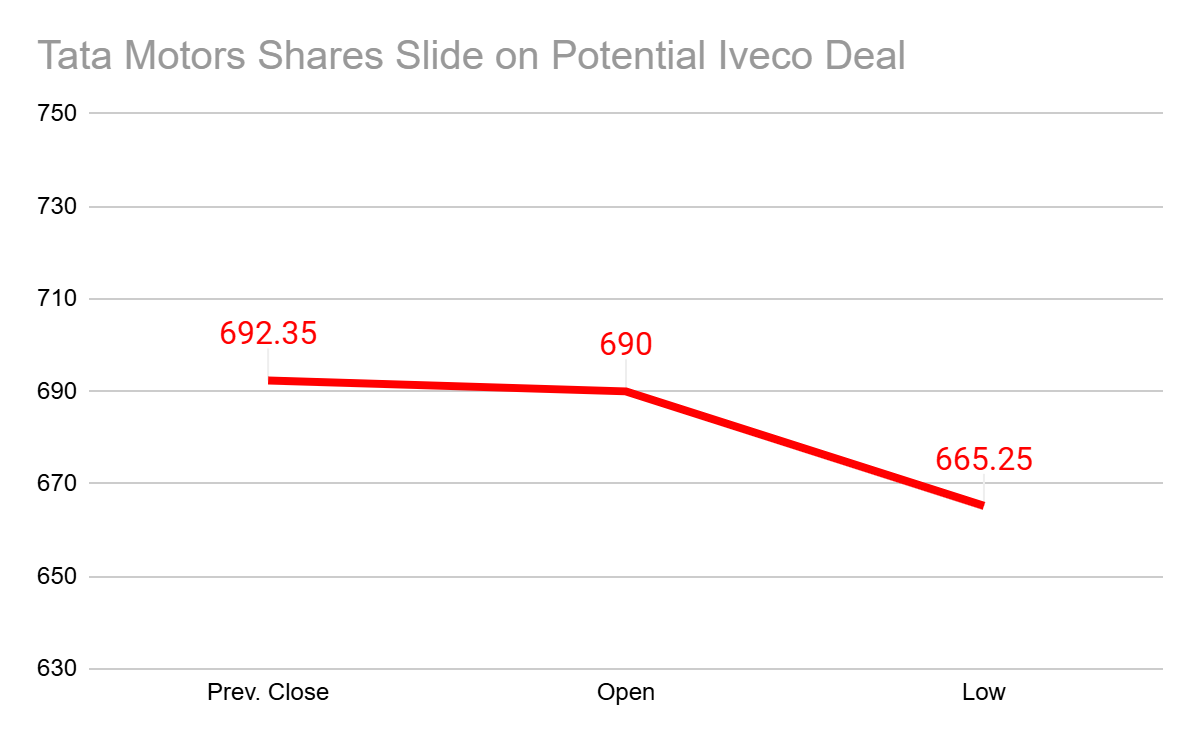

Following reports of the deal, Tata Motors shares fell over 4% on July 30, 2025. Year-to-date in 2025 so far, Tata Motors stock has declined by 10%.

Tata Motors Iveco Deal Structure and Terms

According to reports, Tata Motors plans to acquire 27.1% of Iveco from Exor and then offer to buy the remaining shares from smaller shareholders. However, the deal will exclude Iveco’s defense business, which is being separated.

Iveco has confirmed that it is in advanced discussions over a potential sale, and its shares rose 7.4% intraday on Tuesday after the news. So far in 2024, Iveco’s stock has more than doubled, valuing the company at $6.15 billion.

Top Cross-Border Deals by Tata Group

| Company | Acquisition | Year | Deal Value ($) |

| Tata Steel | Corus | 2007 | 12 b |

| Tata Motors | JLR | 2008 | 2.3 b |

| Tata Tea | Tetley | 2000 | 407–430 m |

| Tata Steel | NatSteel | 2004 | 292 m |

| Tata Coffee | Eight O’Clock Coffee | 2006 | 220 m |

CY24 Financials of Iveco’s Industrial Business

- Iveco’s industrial business generated a revenue of €15 billion.

- The adjusted EBIT (Earnings Before Interest and Taxes) stood at 5.7%.

- The company reported free cash flows of €402 million.

- Europe contributed to 74% of Iveco’s total industrial business sales.

Why the Agnelli Family Supports the Deal

The Agnelli family has had a long-standing relationship with Tata Group. Tata Motors had earlier partnered with Fiat, the Agnelli family’s flagship company, in India. The Agnellis are also shareholders in Ferrari and Stellantis (the parent of Fiat). Because of these historic ties, Exor and Iveco’s board are reportedly in favor of a deal with Tata Motors.

Advisors and Deal Timeline

- Morgan Stanley is advising Tata Motors

- Goldman Sachs is working with Exor and Iveco

- Clifford Chance is the legal advisor

Both parties signed an exclusivity agreement to negotiate the deal, which expires on August 1. Tata Motors plans to complete the transaction through a Dutch subsidiary, which will be fully owned by the company.

Iveco: A Strategic Fit for Tata Motors

This acquisition is part of Tata Motors’ strategy to expand its global commercial vehicle (CV) business. Iveco is the smallest among major European truck makers, behind Volvo, Daimler, and Traton, but it has a wide presence in Europe, Latin America, and North America. Europe alone contributes 74% of its revenue.

Tata Motors, on the other hand, earns about 90% of its CV revenue from India. The company plans to spin off its CV division into a separate listed entity by December 2025. In FY25, this division generated ₹75,000 crore in revenue, held a 49% market share in heavy CVs, and 30% in light CVs in India. It also delivered an EBITDA of ₹8,800 crore and free cash flow of ₹7,400 crore. By the time of the demerger, it is expected to be net cash positive.

If Tata successfully acquires Iveco, its total commercial vehicle revenue could jump to over ₹2 lakh crore. However, margins remain a concern. Tata’s commercial vehicle business has an EBIT margin of 9.1%, while Iveco’s adjusted margins are about 5.6%.

Source: Moneycontrol

Iveco’s Business and the Role of the Italian Government

Iveco had earlier said it was planning to either spin off or sell its defense division by the end of 2025, and it had already received interest from potential buyers. In 2021, Italy’s government blocked a takeover bid from Chinese company FAW due to concerns over the defense segment, which made Iveco a strategic asset.

Analysts believe that if the defense business is sold to a local buyer, it would satisfy the Italian government’s conditions and make it easier for Tata to acquire the rest of the company. Iveco’s operations include trucks, buses, powertrains, and specialty vehicles. In 2024, the company had a 13.3% share in the light commercial vehicle market and 8–9% in the medium and heavy CV segment. Trucks make up 70% of Iveco’s industrial revenue, with buses and powertrains contributing 15% each.

Iveco’s management has projected that the industrial business (including the defense unit) could generate Euro 400–450 million in free cash flow in calendar year 2025.

Source: Economic Times

Conclusion

Tata Motors’ potential $4.5 billion acquisition of Iveco marks a bold step in expanding its global commercial vehicle footprint. With strong historic ties, strategic alignment, and the backing of the Agnelli family, the deal could significantly boost Tata’s scale and presence in international markets. However, regulatory approvals, integration challenges, and margin pressures will be key factors to watch as this landmark transaction progresses toward closure.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora