India’s fourth-largest IT company, Wipro, released its Q1FY26 results on July 17 after market hours.

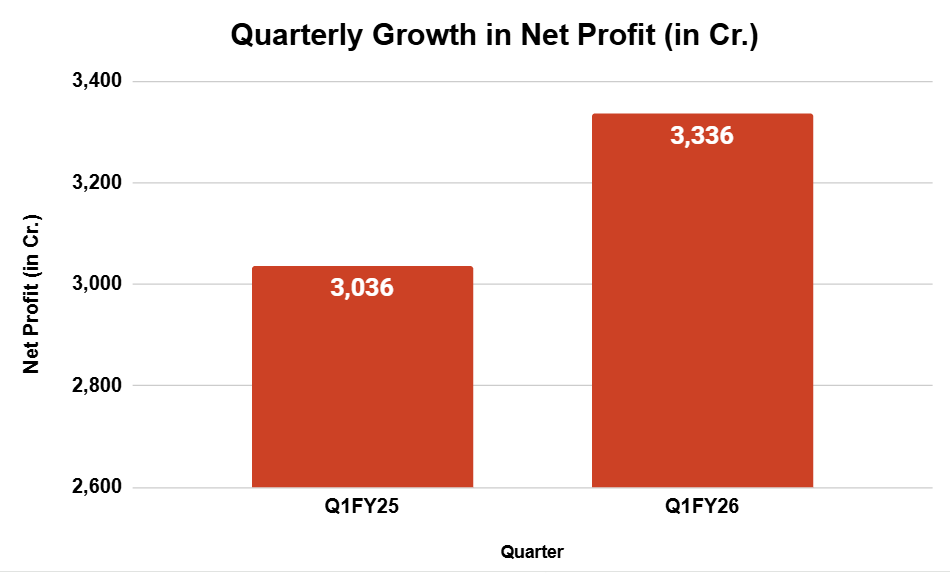

Despite challenging global conditions and sectoral headwinds, the Bengaluru-based IT major reported a consolidated net profit of ₹3,336 crore for the quarter ending June 2025. This reflects a 10% year-on-year (YoY) growth, coming in above street estimates.

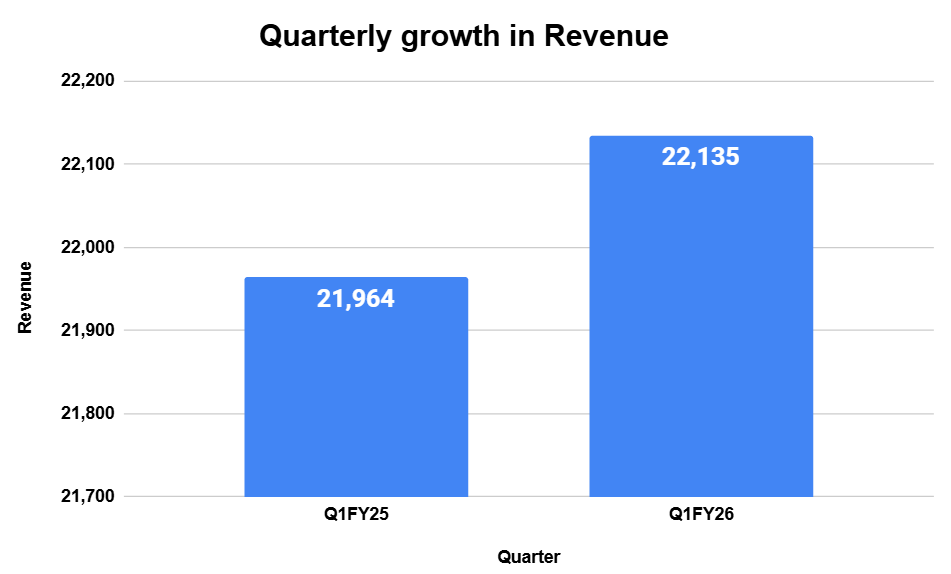

Revenue Performance

Wipro’s Q1FY26 revenue performance reflected a stable yet cautious growth trajectory, striking a balance between market pressures and operational resilience. The company reported steady results in rupee terms while its constant currency performance revealed the impact of global challenges.

Key highlights of Wipro’s Q1 revenue performance:

- Total Revenue (Rupee Terms): ₹22,134 crore

Up from ₹21,964 crore in Q1FY25, exceeding analyst estimates of ₹21,829 crore. - Total Revenue (Constant Currency Terms): $2,590 million

Down 2% QoQ and 2.3% YoY but still ahead of market projections. - IT Services Segment Revenue: $2,587.4 million

Down 0.3% sequentially and 1.5% YoY. - Gross Revenue: ₹22,130 crore ($2,581.6 million)

Decreased 1.6% QoQ but increased 0.8% YoY.

The management pointed out that softness in discretionary spending, particularly in Europe, along with geopolitical uncertainties, contributed to a sequential decline in revenue.

However, the company’s diversified sector presence provided a partial cushioning, with stable revenue flow from banking, energy, and healthcare clients.

Source: Wipro Q1 Results

Despite the challenges, Wipro’s performance exceeded market expectations in rupee terms, indicating effective management of existing contracts and steady execution of large deals.

Profitability and Margins

Wipro’s profitability metrics showed strength and stability, supported by disciplined cost management and operational efficiencies. The company posted a net profit of ₹3,336 crore in Q1FY26, representing a 10% YoY growth, above analyst estimates.

Key profitability indicators:

- Net Profit: ₹3,33 crore

10% YoY growth, but 7% decline sequentially. - EBIT Margin: 17.3%

Expanded by 80 basis points YoY, supported by operational efficiencies. - Operating Cash Flows: ₹4,110 crore ($479.6 million)

Up 9.8% QoQ and 2.9% YoY; representing 123.2% of net income. - Sequential Net Income Decline: 6.7%

Attributed to revenue softness and cautious client budgets.

Management highlighted that despite the sequential decline in net profit, the company successfully expanded margins and maintained strong cash flows. This was achieved through strict resource utilization, cost control measures, and prioritizing high-margin services.

Source: Wipro Q1 Results

Total Bookings and Deal Wins

Despite revenue pressures, Wipro reported a significant improvement in its total bookings and large deal wins:

- Total Contract Value (TCV) reached $4,971 million in Q1FY26, showing a 24.1% QoQ increase and a robust 50.7% YoY growth.

- Large deal bookings came in at $2,666 million, marking a 49.7% QoQ rise and a massive 130.8% YoY surge. This is a clear indicator of Wipro’s continued traction in securing big-ticket, long-term projects.

Srini Pallia, CEO and Managing Director, highlighted that Wipro signed 16 large deals during the quarter, including two mega deals. He noted that the focus from clients remained on efficiency and cost optimisation.

Source: Wipro Q1 Results

Dividend Announcement

Alongside the Q1FY26 results, Wipro announced an interim dividend of ₹5 per equity share of ₹2 each. The record date has been set for July 28, 2025, and the dividend payment is expected on or before August 15, 2025.

This move underlines the company’s continued commitment to shareholder returns even amidst a challenging business environment.

Guidance for Q2FY26

Looking ahead, Wipro has provided a cautious guidance for the second quarter:

- The company expects revenue from its IT Services segment to range between $2,560 million and $2,612 million, implying a sequential growth of -1.0% to 1.0% in constant currency terms.

This guidance reflects the company’s view of continued market volatility and client budget constraints.

Hiring Plans and Attrition Trends

Wipro also shared updates on its hiring and workforce management strategy:

- The company plans to hire 10,000 freshers in FY26, though the hiring will be largely demand-driven.

- According to Chief Human Resources Officer Saurabh Govil, Wipro has sufficient bench strength but will continue to engage with campuses to build its talent pool.

- Voluntary attrition remained stable at around 15.1% over the trailing 12-month period, consistent with the past three quarters. However, certain skill areas continue to witness elevated attrition levels.

Source: The Hindu

Focus Areas and AI Push

Srini Pallia emphasised that AI and data modernisation have become central to Wipro’s client engagements:

- The company has developed over 200 AI agents in collaboration with hyperscalers.

- These AI solutions are deployed across sectors such as banking, energy, manufacturing, technology, and healthcare, delivering measurable outcomes in HR, finance, legal, and project delivery functions.

- Wipro’s AI capabilities are expected to help maintain competitiveness and create new revenue streams, particularly as clients move from experimental pilots to scaled AI deployments.

Source: The Hindu

Geopolitical and Sectoral Trends

Management acknowledged ongoing geopolitical uncertainties and tariff issues, particularly in Europe. However, the BFSI segment showed a strong pipeline, while retail, CPG, technology, and telecom sectors exhibited varying degrees of softness.

Vendor consolidation and cost optimisation remained key client priorities. Nevertheless, Wipro’s leadership expressed cautious optimism, citing its healthy pipeline of large transformational deals and AI-powered consulting offerings as growth enablers for the second half of FY26.

Conclusion

While Wipro’s Q1FY26 results present a mixed picture with revenue softness and sequential profit decline, the company’s strong YoY profit growth, significant deal wins, stable margins, and focus on AI solutions reflect resilience.

The interim dividend announcement and robust bookings offer positive signals for investors, while the cautious Q2 guidance highlights the challenges ahead.

Overall, Wipro’s strategy of focusing on operational efficiency, large deals, and AI-powered transformations appears to be keeping it relatively stable amid a tough global IT services environment.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora