The Indian stock markets are set for a busy second half of 2025, with companies planning to raise over ₹2.58 lakh crore through initial public offerings (IPOs).

Big names from sectors like financial services, consumer electronics, and startups, including unicorns are preparing to go public.

This surge in IPOs is being driven by strong investor interest, steady mutual fund inflows, and private equity firms looking to exit their investments. It could very well turn out to be one of the biggest fundraising seasons in recent years.

Source: Economic Times

New-Age Businesses Dominate the 2025 IPO Pipeline

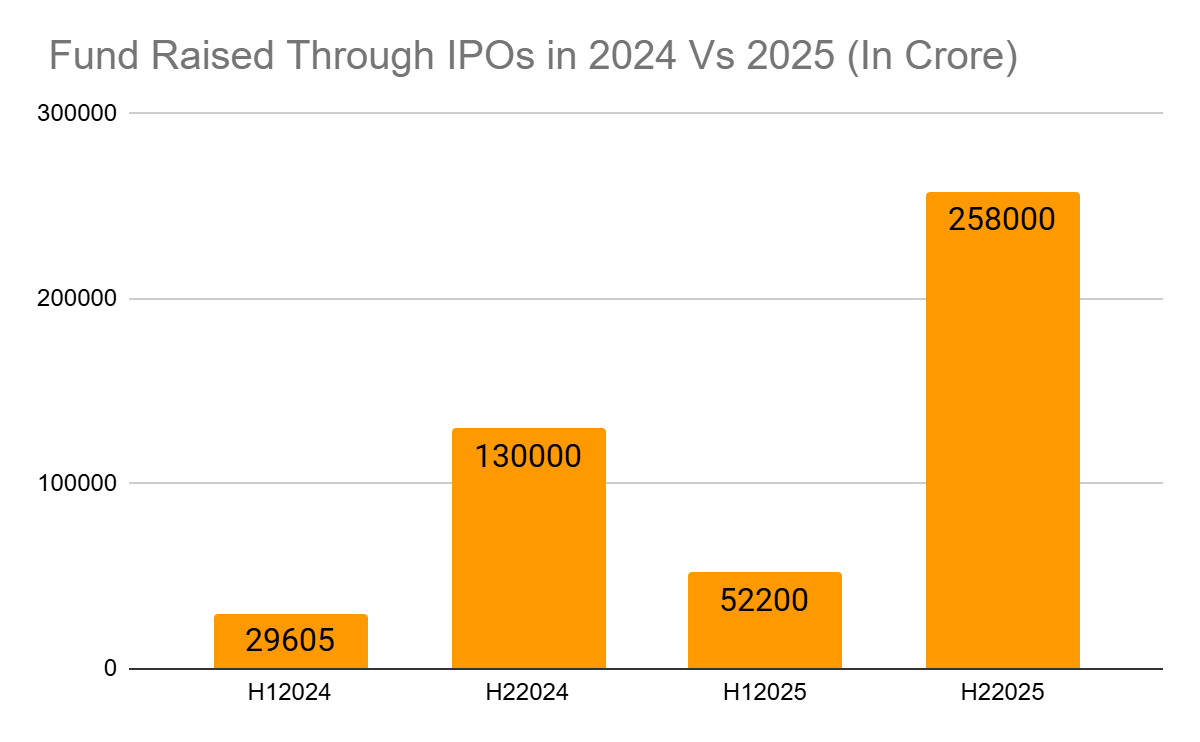

In the first half of 2025 (January 2025 to June 2025), 26 companies raised a total of ₹52,200 crore through IPOs. The biggest issue during this period came from HDB Financial Services, which alone raised ₹12,500 crore.

Looking ahead, the IPO pipeline for the rest of 2025 is packed with new-age and tech-driven businesses. Companies such as Meesho, PhonePe, Boat, WeWork India, Lenskart, Shadowfax, Groww, and Physics Wallah are preparing to launch their IPOs.

The expected issue sizes range between ₹1,500 crore and ₹9,000 crore. Other well-known startups in line for a market debut include Pine Labs, Amagi, Wakefit, Urban Company, TableSpace, and Shiprocket, reflecting the growing strength of India’s digital and consumer-focused sectors.

Source: Economic Times

Comparing with Previous Year: 2024 IPO Data

To put things in perspective:

- H1 2024: 34 IPOs raised ₹29,607.95 crore

- H2 2024: 56 IPOs raised a whopping ₹1.30 lakh crore

This shows a clear momentum building in the second half of the calendar year, a trend that is expected to continue in 2025 as well.

Source: Economic Times

Issues in the Pipeline

Some of the most anticipated upcoming IPOs include:

| Company | Estimated Issue Amount (in Crore) |

| Tata Capital | 17,200 |

| LG Electronics India | 15,000 |

| ICICI Pru Asset Management | 10,200 |

| Inox Clean Energy | 6000 |

| GROWW | 5950 |

| Credila Financial Services | 5000 |

| Dorf Ketal Chemicals India | 5000 |

| Physics Wallah | 4,600 |

| Meesho | 4,250 |

| JSW Cement | 4000 |

Source: Economic Times

SEBI Approvals and Pending Applications

According to Prime Database, IPOs worth ₹1.15 lakh crore have already received approval from the Securities and Exchange Board of India (SEBI) and are ready to launch.

Meanwhile, IPOs worth an additional ₹1.43 lakh crore are in the queue, awaiting regulatory clearance.

This takes the total IPO pipeline for H2 2025 to a whopping ₹2.58 lakh crore.

Source: Economic Times

What’s Driving the IPO Surge?

Several factors are contributing to the bullish IPO trend:

- Strong Mutual Fund Inflows: Equity mutual funds have seen consistent inflows, providing a solid base of retail and institutional participation in IPOs.

- Private Equity Exits: Many private equity firms are using IPOs as a preferred route to exit their investments.

- Favorable Market Sentiment: A generally optimistic outlook on India’s economic and corporate growth is encouraging companies to go public.

- Increased Retail Participation: More retail investors are entering the market via apps and digital platforms, enhancing IPO demand.

Key Sectors in Focus

- Financial Services: A dominant contributor, with firms like Tata Capital and HDB Financial leading the way.

- Consumer Tech and Startups: Unicorns like Groww, PhonePe, and Meesho highlight the maturity of India’s startup ecosystem.

- E-commerce & Edtech: Firms such as Lenskart and Physics Wallah represent sectors with strong digital growth narratives.

- Logistics & Furniture: Companies like Shadowfax and Wakefit point to growing interest in specialised services and D2C brands.

Conclusion

With over ₹2.58 lakh crore in offerings lined up, H2 2025 could turn out to be one of the most active IPO seasons in Indian history. As more companies look to tap into growing investor interest and capitalise on market liquidity, Dalal Street may witness record-breaking activity in the coming months.

Investors should do well to conduct thorough research and due diligence before applying for any IPO. Happy Investing.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora