Fundamental Analysis of Stocks – Blog Category

Fundamental analysis of stocks based on the quarterly and annual reports of the companies.

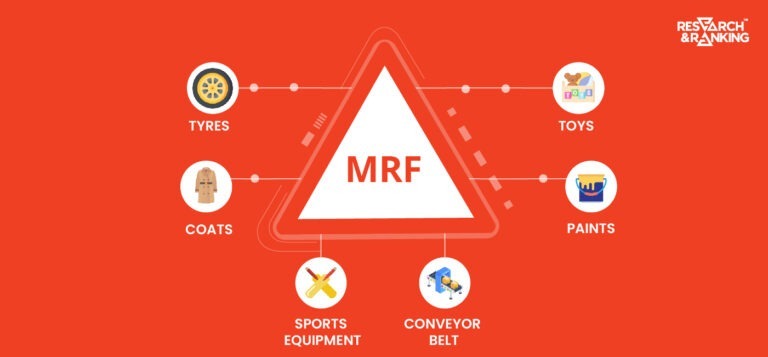

Introduction MRF recently reached a significant milestone in the Indian stock market. The share price surpassed the distinctive ₹1 lakh […]

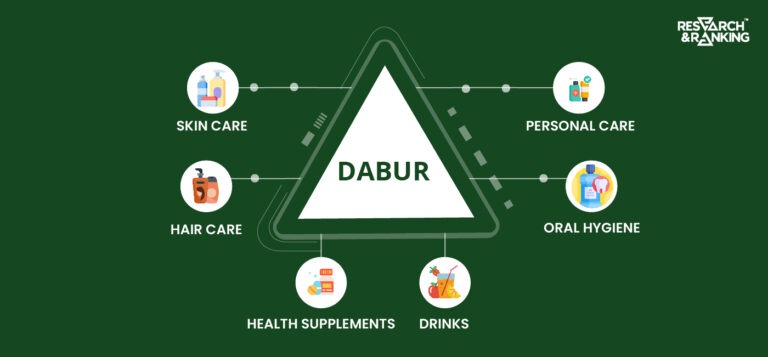

Dabur has been a household name in India’s FMCG sector for over 100 years. It has successfully transitioned from a […]

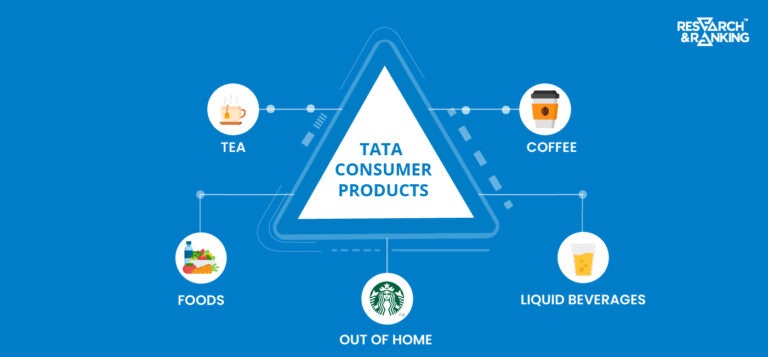

Introduction For a very long period, the fast-moving consumer goods business for the Tatas largely comprised just iodized salt and […]

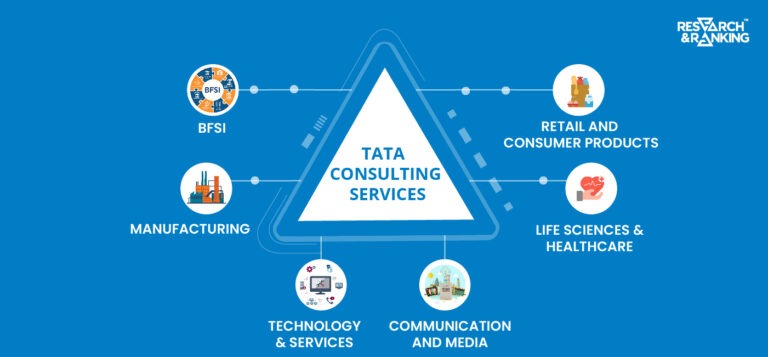

Introduction India is the top offshoring destination for IT companies, and Tata Consultancy Services is among the biggest beneficiaries of […]

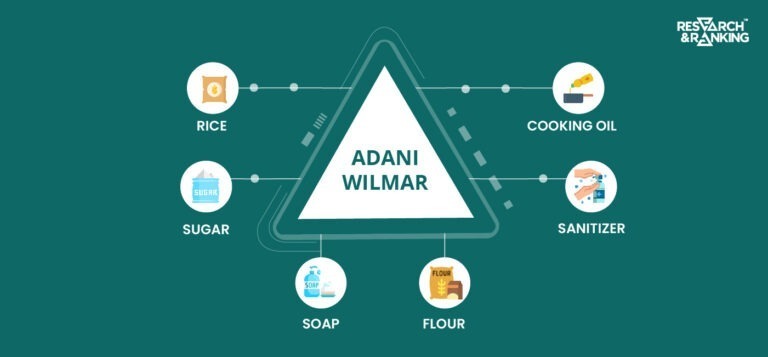

Introduction Talk about Kitchen supplies; this company is sure to find a space on your kitchen shelves. It sells most […]

In India, there are three banks- SBI, HDFC Bank, and ICICI Bank classified as D-SIBs, meaning their failure can impact […]

Introduction PhonePe has a significant percentage of UPI transactions in India. Ever since demonetization, usage of UPI has increased significantly […]

Introduction If you have ever invested in an NBFC (Non-Bank Finance Company), you would know it is risky. Only a […]

Introduction Hindustan Unilever is one of India’s oldest and largest FMCG companies. It is impossible not to have used their […]

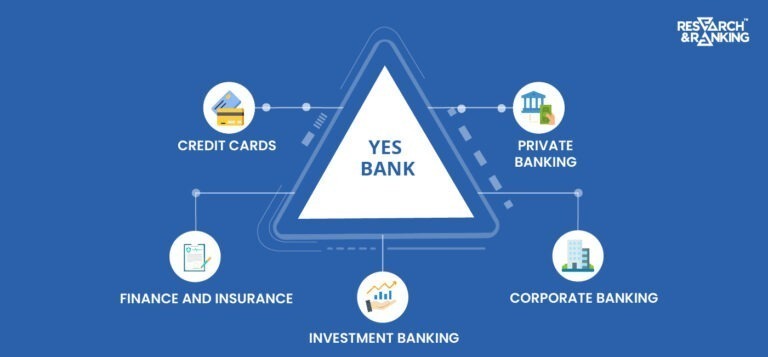

Introduction If we ask you to name India’s biggest wealth destroyers, Yes Bank would probably be the first to come […]

Frequently asked questions

Get answers to the most pertinent questions on your mind now.

What is an Investment Advisory Firm?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Do we have SEBI registration as an Investment Advisory?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Why choose a SEBI Registered Investment Advisor?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

What is the Role of an Investment/Stock Market Advisory Firm in India?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.