Fundamental Analysis of Stocks – Blog Category

Fundamental analysis of stocks based on the quarterly and annual reports of the companies.

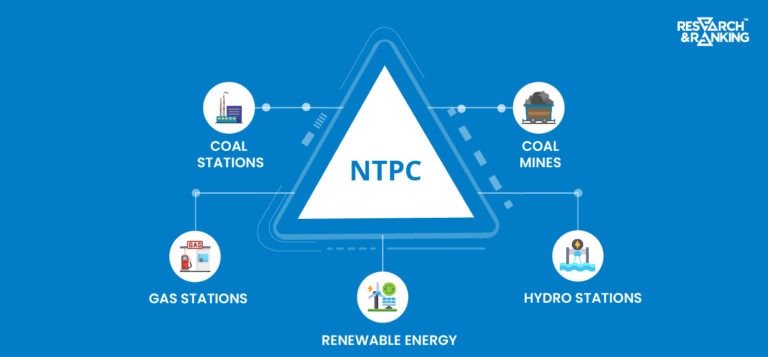

Introduction The vision of this company is “To be the World’s leading power company, energizing India’s growth,” and it has […]

Introduction India has set a very ambitious target of meeting 50% of its energy requirements through renewables and reducing cumulative […]

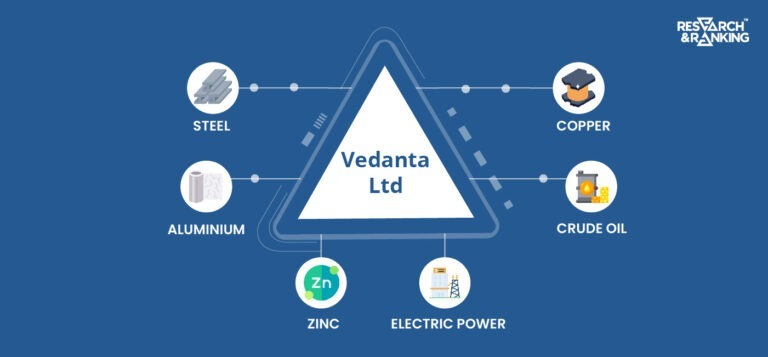

Introduction If you search for the highest dividend-paying companies or dividend aristocrats, Vedanta Ltd. is sure to be at the […]

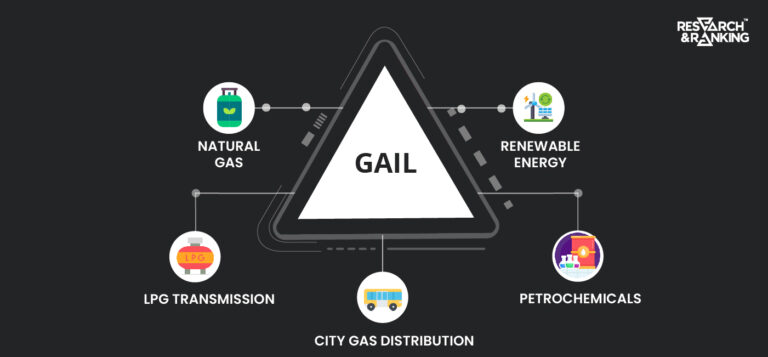

Introduction Energy security is vital for the prosperity and growth of any nation. Adequate availability of coal, petroleum products, and […]

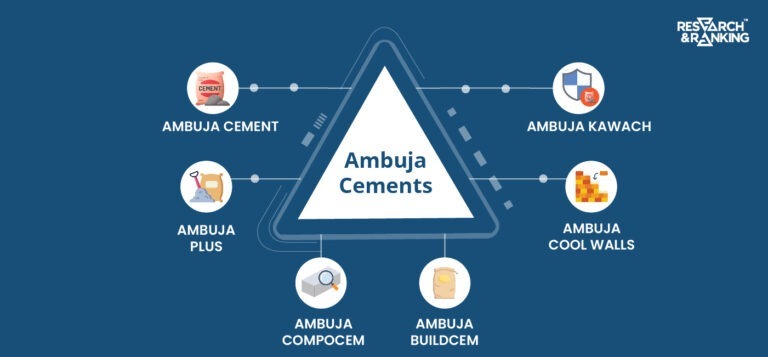

Introduction Do you remember these lines from an ad film featuring Boman Irani? Bhaiya Yeh Deewar Tootti Kyu Nahi?!! Tutegi […]

Introduction Varun Beverages is the second-largest bottling company for PepsiCo beverages in the world outside the United States. It manufactures, […]

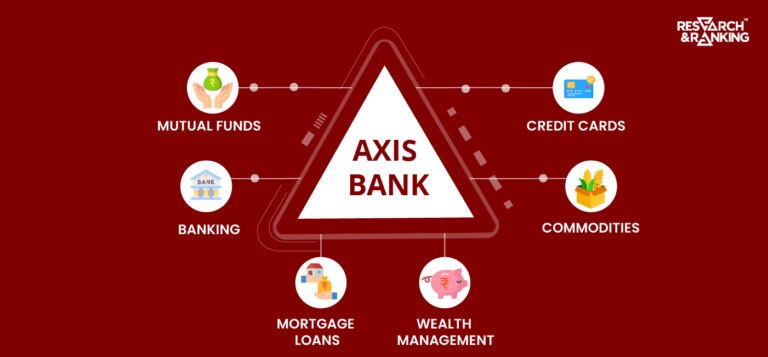

Introduction Axis Bank, earlier known as UTI, was the first of the new private banks to have begun operations in […]

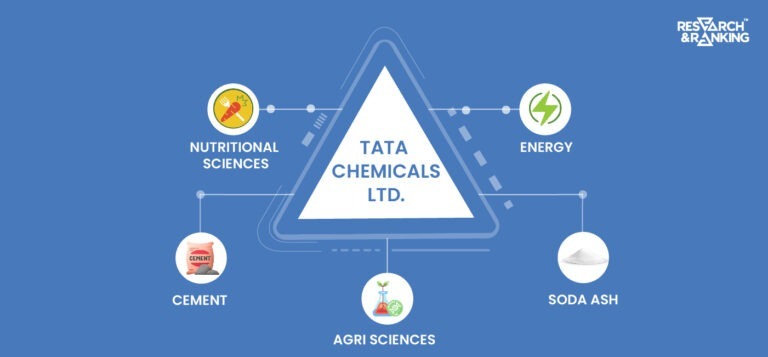

Introduction Did you know that Tata Chemicals is in almost every household in India? It’s true! In 1983, Tata Chemicals […]

In this dynamic world of finance, investors often face challenges when choosing between Bajaj Finserv and Bajaj Finance. These NBFC […]

Introduction Britannia is a brand many generations of Indians have grown up with, with several cherished and loved brands in […]

Frequently asked questions

Get answers to the most pertinent questions on your mind now.

What is an Investment Advisory Firm?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Do we have SEBI registration as an Investment Advisory?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Why choose a SEBI Registered Investment Advisor?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

What is the Role of an Investment/Stock Market Advisory Firm in India?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.